Agriculture is experiencing rapid challenges and changes worldwide. Pressures from climate change, increasing demand and short supply of food, green energy and mechanisation amidst unemployment are part of the reality in the sector. Consumers’ changing preferences and increasing regulations on quality control add to the many hurdles a farmer has to face. Urbanisation is contributing to the demand for new technology. The choice of essential oil or vegetable seed oils as a crop can be a viable option in Namibia, which is specifically blessed with speciality seed oils.

Consider the following facts regarding essential oils and vegetable/seed oils:

- They are high-value products sold predominantly to the international cosmetic and aromatherapy markets.

- Brazil, China, the USA, Egypt, India, Mexico, Guatemala, Morocco and Indonesia are the major producers of essential oils. Other countries need to import it.

- The EU dominates world trade but no single country among them, is a major producer.

- About 65% of world production comes from developing countries.

- There are approximately 160 essential and vegetable oils traded globally.

- The top 10 oils make up some 80% of world trade.

- The world trade in essential oils is divided into two components, referred to as the major and minor oils. Major oils are those oils traded in large quantities (but often at lower prices).

- Recent studies suggested that the value of the global essential and vegetable seed oil market is set to reach USD 11.67 billion by 2022 (Ultra International B.V. 2016).

- This growth is primarily based on growing consumer awareness regarding the health benefits associated with natural and organic ingredients in personal care, beverages, and household products.

There can be no doubt that the market is vibrant and that countries from the SADC can provide the deficit in supply. The possibility of adding value and optimal utilisation of one’s crop make the industry of essential and vegetable oils a viable option. Further advantages are that the product has a long shelf life and the demand is currently growing at 12-25% per year, with a constant short supply. In the case of vegetable seed oils, Southern Africa is a very small role player. The cosmetic market is the fastest-growing segment of the market and the tendency of using natural products in even veterinary and industrial products adds to the growing demand.

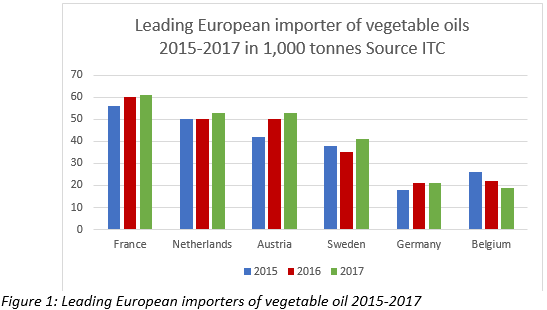

Figure 1 gives an overview of the six leading European importers of speciality vegetable oils. France presents a ready market for speciality vegetable oils used in cosmetics but only 15% of the country’s imports in 2017 originated directly from developing countries. France’s main suppliers are European vegetable oil producers (Spain) as well as traders and processors in The Netherlands, Germany and Belgium. The Netherlands is the largest importer of vegetable oils from developing countries. In 2017, 49% of the country’s total imports of speciality oils originated from developing countries. The Netherlands houses several large oil refineries and traders. Its main suppliers of all vegetable oils outside of Europe include Ghana, Togo, Burkina Faso and China. Austria’s imports from 2015 to 2017 grew more quickly than the European average (by 25%). However, direct imports from developing countries are negligible (less than 6%). In 2017, Austria’s main suppliers included Germany, Italy, Poland and The Netherlands. Swedish imports increased by 12% over the last three years. Over 98% of Swedish imports of speciality oils originate in Denmark. Denmark is home to large vegetable oil producers and refineries, such as AAK. Germany is an important trade hub for high-value vegetable oils. In the last three years, the country’s imports of vegetable oils increased by 17%. Germany’s main suppliers in 2017 included The Netherlands, Italy and Austria.

While Belgium’s total imports of speciality vegetable oils decreased by 25% from 2015–2017, Belgian imports of such oils from developing countries increased by 33% over the last three years. This is much higher than the European average. Belgium’s main suppliers outside of Europe are Ghana and India. Although Italy, the United Kingdom and Switzerland are smaller importers of speciality vegetable oils, these countries might be interesting markets for marula oil. Italy and the United Kingdom imported a relatively large share directly from developing countries, having been between 25% and 29% in 2017. Swiss imports from developing countries experienced strong growth in the last three years (by 74%).

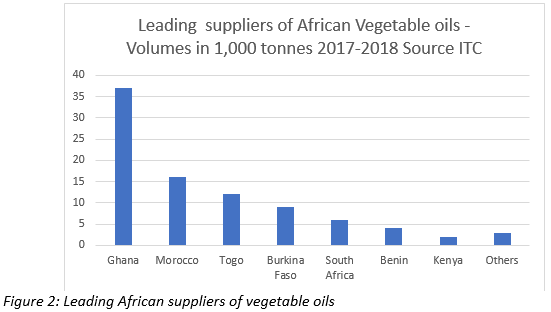

Figure 2 indicates a range of speciality vegetable oils. Although not all are used in cosmetics or fruit seed oils, these oils are often used as substitutes. Examples of speciality oils imported from these countries are:

- Marula oil.

- Argan oil.

- Kalahari melon oil.

- Baobab oil.

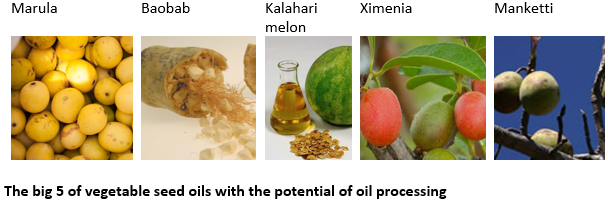

Three of these oils can be produced in Namibia. Ximenia and Manketti can be added to the basket of Namibian oils. Downstream value-adding include the production of creams, lotions, body butter, shampoos, lip balms and as a carrier in massage oils. Food products from the pulp like juices, jams and dried fruit are done as well and compliment the operation of oil processing. The manufacturing of these products can create more employment and skills development not attended to before. There are also by-products of these products e.g. seed cake for animal feed. If this can be optimized, less imports will result and exports of finished products through agro-processing will have a positive effect on the economic growth much needed.

By: Karen Swanepoel

Executive Director: Southern African Essential Oil Producers’ Association (SAEOPA)

For more info, contact : secretary@saeopa.co.za